How to Record an Accounting Transaction?

When an accounting transaction occurs, it can be recorded in the books of an organization in a number of ways. The following bullet points note the most common methods available:

Journal entries. The most basic method used to record a transaction is the journal entry, where the accountant manually enters the account numbers and debits, and credits for each individual transaction. This approach is time-consuming and subject to error, and so is usually reserved for adjustments and special entries. In the following bullet points, we note the more automated approaches used in accounting software to record the more common accounting transactions.

Receipt of supplier invoices. When a supplier invoice is received, the accountant logs it into the accounts payable module in the accounting software. The module automatically creates a journal entry that debits the relevant expense or asset account and credits the accounts payable liability account.

Issuance of the supplier invoice. When an invoice is to be created for a customer, the accountant enters the relevant information about the price, unit quantity, and applicable sales tax into the billing module in the accounting software. The module automatically creates a journal entry that debits either cash or the accounts receivable account and credits the sales account. There may also be a credit to the sales tax liability account.

Issuance of supplier payments. When suppliers are paid, the accountant checks off the invoice numbers to be paid in the accounts payable module in the accounting software. The software then prints checks or issues electronic payments, while also debiting the accounts payable account and crediting the cash account.

Issuance of paychecks. When employees are to be paid, the accountant enters the pay rates and hours worked of all employees into the payroll module of the accounting software. The module automatically creates a journal entry that debits the compensation and payroll tax expense accounts and credits cash. This can be quite a complex entry, since it may also address garnishments and other deductions, and separately record several types of payroll taxes.

These recordation methods all create entries in the general ledger, or else in a subsidiary ledger that then rolls into the general ledger. From there, the transactions are aggregated into financial statements.

The Process Of Recording Transactions.

Recording business transactions is the process of entering business events into the accounting system, which is more common and very automated now, or accounting books. By recording transactions, we translate business transactions into accounting records. Accountants follow three steps methodology in recording transactions:

- Understand the business transaction;

- Identify the affected accounts;

- Meet the conditions of the double-entry accounting concept.

1.Understand the business transaction.

The responsible person would need to collect the required information to understand the nature of the transactions (whether it is a purchase or a payment, and so on) and know the monetary value of the transaction and parties of the transaction. This understanding of the business transaction is achieved by examining source documents. There are several main financial transactions one would come across:

- Sales – sell goods and/or services; with a cash sale, a customer pays at the time of sale, while with on account sale, the business allows the customer time to pay;

- Purchases – purchase goods and/or services; with cash purchase, the business pays the supplier at the time of the purchase, while with on account purchase, the suppliers allow the buyer time to pay;

- Payments – receive customer payment either at the time of the sale (cash sales) or a payment from a sale made on account (credit sale);

- Payroll – pay employees’ salaries and wages;

- Loans – borrow money and repay money borrowed on loans;

- Pay owners – owner withdrawals.

For example, an accountant would know that an organization has made a purchase transaction by examining the invoice received from the supplier or there is an increase in the Inventory account by examining the goods received the note.

2.Identify the affected accounts.

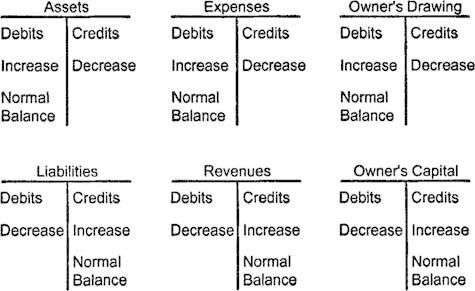

The second step is to identify the affected accounts and how they will be affected – debit or credit, depending on whether it is an Asset, Liability, or Equity account. For example, in a purchase transaction, at least one Asset account will be affected, whether we debit Inventory or Fixed Asset or credit Cash, if it is a cash transaction.

Always keep in mind that in a typical business transaction, we get something and we give up something, which is the basis of the double-entry accounting concept. This means that with every transaction an accountant records, there will be at least two accounts that will be involved in the process of creating journal entries for the transaction. After recording transactions in the journal, you need to transfer them to the general ledger.

3.Meet the conditions of double-entry accounting.

The final step is to check whether the debits and the credits of the recorded event meet the conditions of the double-entry accounting and everything is still in the balance. If you are still learning which account to credit and which to debit, refer to the illustration below.